Our Simple Guide To Loans

In the eyes of many lenders the sad fact is that the more money you have the less of a risk you are thought to be. The lower the risk a lender thinks you are, the lower the rate they will charge you.

Therefore, if you are of low to middle income or have a poor credit history, lenders believe that you may at some point struggle to pay the required instalments. The risk of possible non-payment is passed onto the customer in the form of higher interest rates as not all lenders want to undertake this risk/expense.

Therefore, if you are of low to middle income or have a poor credit history, lenders believe that you may at some point struggle to pay the required instalments. The risk of possible non-payment is passed onto the customer in the form of higher interest rates as not all lenders want to undertake this risk/expense.

There are often fewer lenders willing to lend money to customers with low to middle incomes and/or have poor credit histories, which is why it is often more difficult and more expensive to get a loan if you fall into this category.

When looking for a loan, make sure that you know what your own credit profile and history is like before applying so that you are fully aware of the options available to you. Make sure you understand exactly what type of loan you’re taking out, how much it’s really going to cost you and if you can really afford the repayments.

What Are Secured Loans?

A secured loan is exactly that: secured against something that you own.

The majority of secured loans are secured against a property, normally your home/the property that you are currently living in.

Secured Home Owner Loans tend to be cheaper than other types of loans as the lender has the added security of being able to repossess (and sell) the property if for any reason the customer was to stop making payments. The risk to the lender of losing their money is lower, which usually means their interest rates are lower.

If you own a property then it is possible that you may qualify for a secured loan.

For more information on secured loans click here >>

What Are Unsecured Loans?

Unsurprisingly, an unsecured loan is not secured against something you own, and is granted on the condition that you will make regular repayments until it’s paid off in full.

Because there is no security for the lender if payments were ever to stop, the risk of a lender losing their money is higher. Therefore lenders will charge a higher interest rate as a way of offsetting the higher level of risk.

Examples of unsecured loans are: a bank overdraft, guarantor loan or a payday loan.

For more information on unsecured loans click here >>

What Are Guarantor Loans?

A guarantor loan is a type of unsecured loan that involves having someone else ‘vouch’ for your ability to pay it back, and they are often for customers with bad credit.

A lender will need someone else (often a friend or family member) to sign an agreement saying they will step in and make repayments if you for any reason ever fail to make a payment. Often the lender will require your guarantor to have good credit and, more often than not, be a homeowner.

Therefore if the main borrower can no longer afford to repay the loan, then the guarantor will become liable for the full balance and regular payments. Anyone being asked to become a guarantor should seek independent legal advice before agreeing to do so.

For more information on guarantor loans click here >>

What Are Logbook Loans?

A logbook loan is a quick personal loan that is secured against your car. If you take out a logbook loan and fail to make the repayments then the lender can take possession of (and sell) your car to try and regain their money.

Until a logbook loan is repaid in full the lender is technically the legal owner of the vehicle, however the customers can continue to drive the vehicle as normal. Once the loan has been paid off, the ownership of the vehicle goes back to the customer.

Logbook loans are designed for people with a poor credit history, and as such they tend to have a high interest rate to offset the risk of lending to a person with bed credit.

It is worth noting that the interest rates of a logbook loan, although high, are often lower than those charged by payday lenders. This is because the customer is using their car as security, which may reduce the risk of the lender losing their money in the event of the loan not being repaid.

For more information on logbook loans click here >>

What Are Payday Loans?

A payday loan is a high cost unsecured short-term loan designed to tide people over until their next payday.

When you take out a payday loan, you agree to pay back your loan, plus interest, by a specific date.

Payday loans are an extremely expensive form of finance, and should be used in times when cash is required urgently. For example car repairs, boiler repairs etc. Payday loans should not be used to supplement your regular income, and equally should not be used on a regular basis. Payday loans should be used only by those customers who can repay the loan balance on the pre-agreed date.

Interest rates on payday loans are extremely high, as they are usually taken out by people with a poor credit rating who are considered high risk.

For more information on Payday Loans click here >>

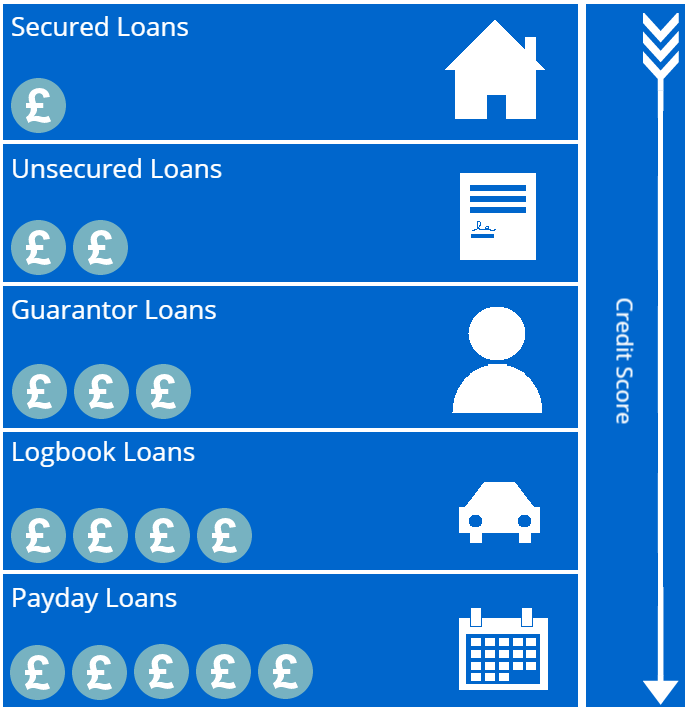

Loans at a glance…

The following table indicates the cost of each loan product, and the more £ in the table, the higher the overall rate for the loan type.

There are some exceptions to the rule, hence why it is important to shop around using a price comparison website that you can trust.

Understanding the Cost of Borrowing

When you’re desperate for cash, it can be tempting to take whatever loan you’re offered without thinking of the long-term consequences.

But before you sign on the dotted line, it’s essential that you understand the total cost of repaying the debt.

The true cost of borrowing takes into account:

- The loan amount

- The length of the borrowing term

- The frequency of repayments

- The rate of interest you’ll be charged

- The cost of any fees

When you have all of this information, you’ll be able to work out the total amount you will have to pay the lender.

Smart Search Technology

Finding the right loan for your circumstances doesn’t have to be challenging or complicated. When you use our Smart Search Technology we’ll present you with a list of loans that best suit your profile, always ranked according to how much interest you’ll pay (APR).

Using Smart Search will not affect your credit score, so enter your details today to find the right loan for you.